No matter where you live in Virginia, storms can affect you.

In this post, and through our data-packed maps, you can learn which counties and cities are the most – and least – affected by storm damage in Virginia.

Weather & Storm Damage in Virginia, 2009-2018

Between the years of 2009 and 2018, the most weather-damaged area of Virginia was Norfolk, which suffered $43.3 million worth of damage. This is more than 10% of the entire total for storm damage in Virginia. By contrast, the area estimated to suffer the least storm damage was the independent city of Manassas, VA, though the surrounding Prince William took its share, estimating $431,000 in damage.

Related: Virginia Hurricanes: The 11 Most Deadly Storms in History

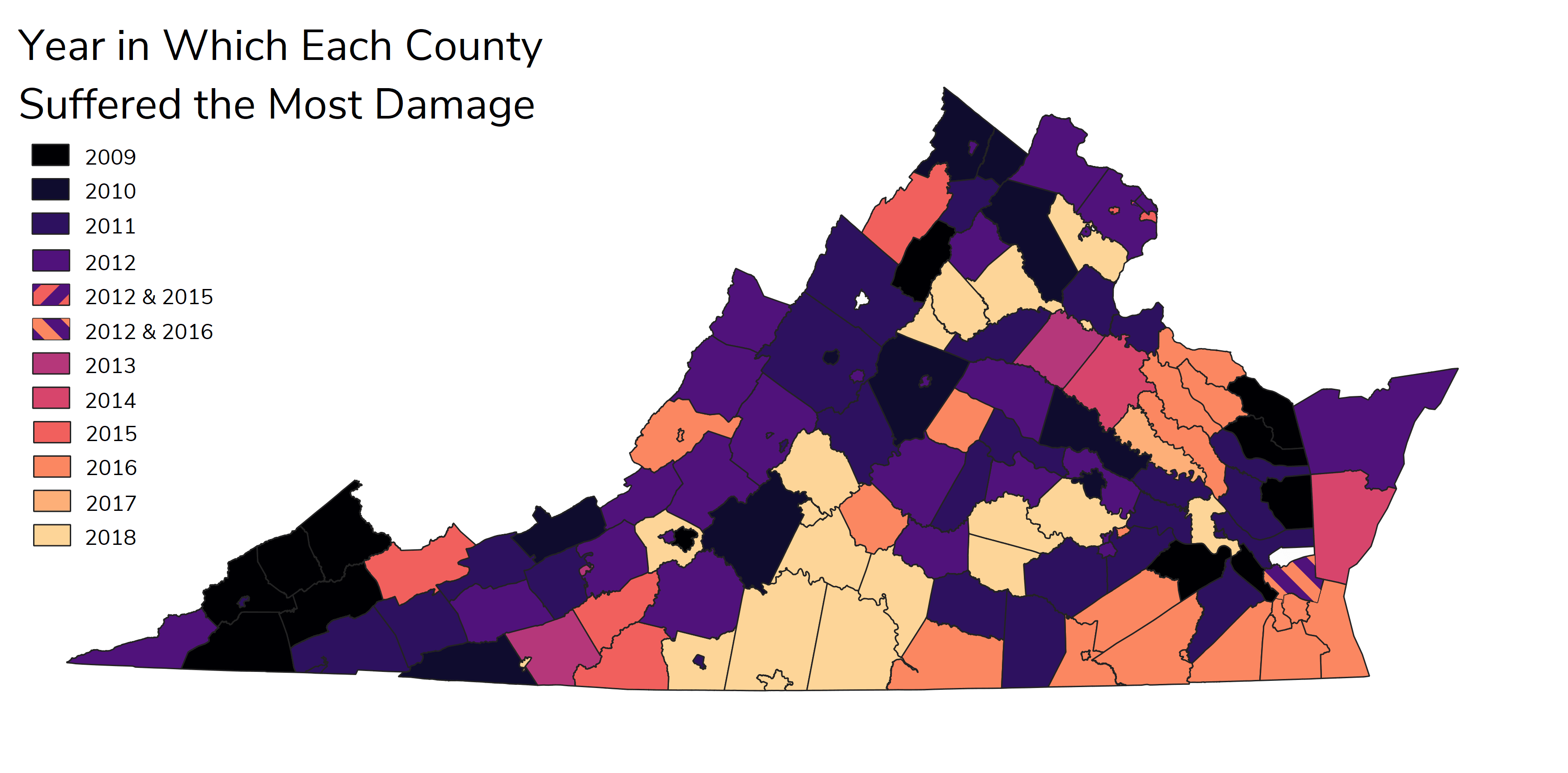

What Was the Worst Year in Each Virginia County for Storm Damage?

In 2018, the City of Lynchburg had the worst year for weather-related damage in Virginia, taking an estimated $28.6 million in damage. Around $18 million of this damage was due to the extreme amounts of rainfall that occurred over the course of several hours in a single day, resulting in a flood and the evacuation of 120 homes.

Related: See the latest weather forecasts from the National Weather Service in Wakefield.

What Kind of Weather Does the Most Damage in Virginia?

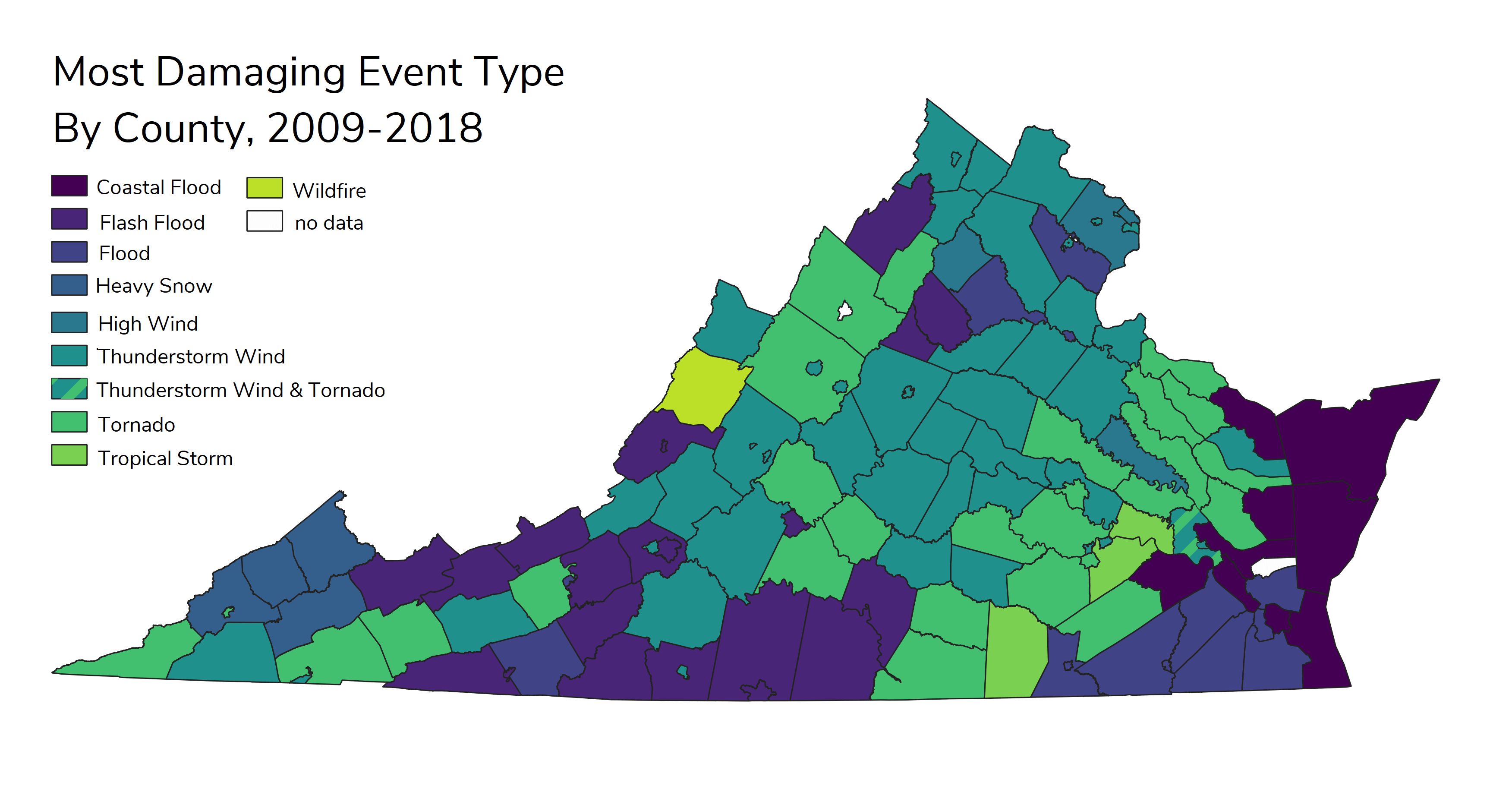

While in every county in Virginia thunderstorm winds were the most damaging wind events, tornados caused the most damage overall, at $99.9 million in costs. The second most-damaging weather cause was flash floods, at $96.1 million. As you can see by this graph, coastal flooding is also a real concern for those living in that region.

Rely on AllClaims Pro Public Adjusting for Storm Damage Claims

When you incur storm damage, to your property, from fire, water, wind, or other causes, the first thing to do is contact your insurance company. They will send out an adjuster to estimate and document the amount of damage. Your insurance company, however, may not give you all that you are entitled to when it comes to storm damage in Virginia. Unfortunately, many people can be denied the coverage to which they are entitled.

That’s when you need to turn to AllClaims Pro Public Adjusting. We can look into your claim on your behalf and ensure that you receive compensation for all that is owed to you by your insurance company. You don’t need to worry about negotiating your claim with your insurance company with AllClaims on your side. We help insurance policyholders process their claims with ease, looking out for your best interest.

See our related post on “When to Hire a Public Adjuster.”

Contact Allclaims Pro Public Adjusting today.